How to Change Your Tax Withholding

Methods to Change Your State and Federal Withholding Allotments

By Nancy Savage

With the 2019 tax code changes, many of you were caught off guard not realizing that your withholding on your annuity may have been adjusted leaving you owing taxes.

Some of you may have contacted the Society asking for advice as to how to adjust the withholding on your federal annuity. There are three ways that you can do this.

1. Call or write the Office of Personnel Management (OPM).

Telephonic: 888-767-6738 (Avoid calling on Mondays, the first of the month, or after a three-day weekend. Start calling at 7:40 a.m. Eastern time. Be prepared for a bit of a wait. Have your CSA Number on hand.)

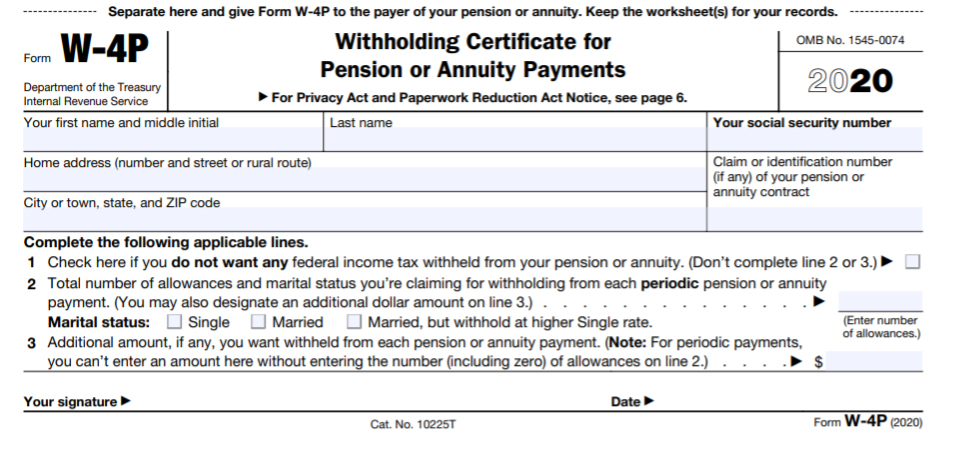

2. Obtain IRS Form W-4P Withholding Certificate for Pension or Annuity Payments. This is an IRS form which can be downloaded from IRS.GOV. The form can be filled out and mailed to:

U.S. Office of Personnel Management

Retirement Operations Center

P.O. Box 45

Boyers, PA 16017

It is recommended that you send a cover letter with your CSA or CSF Number included along with this form.

Alert: This form is cumbersome and can be confusing when all you want to do is increase your federal withholding allotment by $100 per month.

3. Adjust your OPM Online Account (Recommended Method)

If you have an online account with OPM, it is simple and quick to log in and adjust your state and/or federal withholding.

If you do not have an online OPM account, you should think about establishing one. OPM experiences heavy telephonic traffic making them extremely difficult to access. Most of your business with OPM can be handled efficiently through the online account. Once established this account can be accessed through the OPM.GOV website. Go to OPM.GOV, then RETIREMENT SERVICES, then SERVICES ONLINE (SOL). Once you have accessed SOL, you will have immediate access to the following services:

- View/Print 1099-R Tax Forms

- Change Federal and State Income Tax Withholding

- View/Print Annuity Statement/Verification of Income

- View/Print a Year-to-date Summary of Payments

- View/Print Verification of Life Insurance (FEGLI)

- Change Mailing Address

- Change SOL Password

- View the Status of Case while in Interim Pay

- Establish an Allotment to an Organization

- Request Duplicate Annuity Booklet

- Sign up for a Checking or Savings Allotment

- Sign up for Direct Deposit of Annuity Payment

- Update email address

- Opt-in to Receive Information Electronically

- View/Print Retirement Services Card (CSA) Card

The site also has a number of online calculators that you may be interested in, including one for Federal income tax withholding and one for a FEGLI calculator. During the fall open season, you will be able to use the site for health benefits changes.

If you want to open an account you need to obtain a password. Send OPM an email message, including your CSA or CSF Number, to [email protected] with “Password Request” in the Subject line. Your password will be sent to your listed home address with OPM. Once you receive the password, you can go online to OPM.GOV and access your full account and adjust your withholding at will. Remember to access the account several times each year to keep your password and the account active.

Federal Tax Exclusion for Health Insurance Premiums ($3,000)

Many of you are aware of this important exclusion to your income, but, every year, we find those who are not. Not all professional tax preparers and accountants are aware of this exclusion of income, not deduction. Make sure your preparer is aware of IRS Publication 575, Pension and Annuity Income. The information is built into Turbo Tax and may or may not be in other tax software packages.

Many of you are aware of this important exclusion to your income, but, every year, we find those who are not. Not all professional tax preparers and accountants are aware of this exclusion of income, not deduction. Make sure your preparer is aware of IRS Publication 575, Pension and Annuity Income. The information is built into Turbo Tax and may or may not be in other tax software packages.

Retired public safety officers (this category includes retired FBI Agents) can exclude up to $3,000 of federal annuity income from federal taxes. This is the amount paid for health insurance premiums. The information regarding your health insurance is available on your OPM Annuity Statement Form 1099R. Not all tax preparers are aware of this deduction and you may need to point it out to them. You can also include dental insurance and long-term care insurance as long as you have a federal plan that is deducted from your annuity and the total amount is less than $3,000.

Nancy Savage

Executive Director

IRS Publication 575 provides additional information about this deduction.

Click here for additional important information.